Understanding the Skills Gap in Digital Banking

Grasping the Concept of Skill Shortage in the Digital Banking Arena

The digital banking sector has undergone a dynamic transformation, largely fueled by rapid advances in technology. As banks and financial institutions transition to online platforms like Coyyn, there arises a noticeable skills gap. Bridging this gap is critical for maintaining seamless digital transactions and ensuring that users enjoy a user-friendly experience. In today's fast-paced economy, the demand for digital banking services is higher than ever. This shift is primarily due to an increase in digital currencies, such as cryptocurrency, and the growing popularity of blockchain technology. However, with these advances come challenges in fulfilling the necessary skill prerequisites to handle digital financial tools effectively. The skills shortage affects various stakeholders, from businesses aiming to integrate blockchain-based solutions to individuals wanting to manage digital assets. This gap creates an urgency for financial institutions to equip professionals with the right skill set tailored to the evolving demands of the digital market. In response to this challenge, organizations like Coyyn offer innovative solutions to upskill workforce participants, aligning their capabilities with current and future market needs. By focusing on real-time banking capabilities and a comprehensive understanding of blockchain and cryptocurrency dynamics, finance professionals can better meet the expectations of the digital economy. For a deeper dive into tackling this issue across various domains, explore this relevant resource on skills gap in sales teams, where we discuss strategies applicable to the digital banking sector and beyond.The Role of Coyyn.com in Digital Banking

The Impact of Coyyn.com on Digital Banking Evolution

Coyyn.com is making significant strides in reshaping how digital banking functions, emphasizing the seamless integration of cryptocurrencies and blockchain technologies into mainstream financial systems. This platform stands out for its commitment to enhancing the way users engage with digital finance and modern banking. Inclusive Financial Tools Coyyn offers a comprehensive suite of digital tools designed to facilitate both businesses and individual users in managing digital assets effectively. With the rise of cryptocurrencies like Bitcoin and Ethereum, users need a platform that can handle such transactions effortlessly. Coyyn’s user-friendly interface ensures that even those new to the cryptocurrency landscape can operate with confidence. Pioneering Blockchain Solutions Blockchain technology is at the heart of Coyyn's services, providing a secure and transparent environment for conducting financial transactions. By embracing blockchain, Coyyn not only ensures safer transactions but also builds trust among its users—a critical factor in today’s growing digital economy. This move aligns with the global shift towards more decentralized financial models and the increasing adoption of digital currencies. Adapting to the Gig Economy In the current gig economy, where digital capital and gig jobs are the norm, Coyyn helps users navigate the intricacies of managing multiple income streams. The platform’s ability to operate in real-time and handle various digital currencies makes it an invaluable tool for freelancers and entrepreneurs alike. Embracing Future Market Needs As the digital market evolves, the demand for efficient and accessible financial solutions grows. Coyyn continually adapts its services to meet these emerging needs, ensuring that users are well-equipped to handle the future of digital banking. This constant adaptation not only reinforces its position in the market but also contributes significantly to bridging the skills gap in digital financial services. By leveraging technology to bridge skills gaps, as detailed in related content on how technology plays a crucial role in addressing skills deficiencies, Coyyn.com is not just a platform—it’s a key player in the ongoing digital finance revolution.Key Skills Needed in Digital Banking

Essential Competencies for Digital Banking Success

In the fast-paced world of digital banking, professionals need a specific set of skills to thrive. These skills are indispensable for navigating the evolving landscape characterized by rapid technological advancements and changing user expectations. Let's delve into the essential competencies required in the digital banking sector and how platforms like Coyyn.com are shaping those skills.- Technical Proficiency in Blockchain and Digital Assets: With the increasing adoption of blockchain technology and cryptocurrencies, understanding these digital tools is paramount. Professionals must be comfortable with transactions involving digital money, market dynamics, and digital capital management. This competency ensures secure and efficient management of blockchain-based assets and transactions.

- Customer Interaction and Engagement Skills: In the evolving gig economy and digital economy, the user experience remains a priority. Navigating the platform in a user-friendly manner and ensuring online banking services are intuitive and accessible is key. Banking professionals are expected to effectively engage with users, ensuring their needs are met satisfactorily.

- Analytical and Strategic Thinking: The digital finance sector demands analytical prowess to interpret financial trends and strategize accordingly. This skill is crucial when dealing with the volatility of digital currencies and the complex economy Coyyn operates within. Analytic prowess aids in making informed decisions that drive business resilience and success.

- Regulatory Knowledge and Compliance: With financial transactions increasingly moving online, a deep understanding of regulatory frameworks governing digital banking, cryptocurrencies, and blockchain is essential. Ensuring compliance with financial regulations is critical for both users and businesses to operate seamlessly in the ecosystem.

- Adaptability to Technological Changes: Technology is a driving force in digital banking. Professionals must keep pace with technological advancements and integrate new tools into everyday business operations. This skill allows for real-time adaptation to innovations, improving efficiency and service delivery.

Training and Development Strategies

Effective Training Approaches in Digital Banking

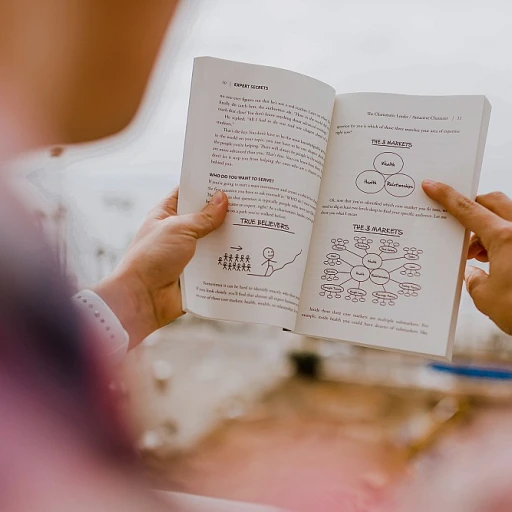

In the ever-evolving landscape of digital banking, it is crucial for organizations to focus on efficient training and development strategies. This ensures that employees stay updated with the latest innovations and maintain a competitive edge. Platforms like Coyyn, which offer specialized digital finance solutions, serve as a foundation for nurturing these skills among banking professionals. Equipping personnel with the right skills involves a multifaceted approach:- On-the-Job Training: Practical, day-to-day experiences at work allow employees to learn through real-time engagement and application of digital tools specific to Coyyn's offerings, such as blockchain and cryptocurrency handling.

- Workshops and Seminars: Regular sessions focused on the complexities of the digital economy, including the effective use of platforms like Coyyn.com, can provide a deeper understanding of market trends, financial transactions, and emerging digital assets.

- Online Learning Platforms: They offer flexible training options where employees can learn at their own pace. Courses tailored to the digital and banking sector, such as those focusing on new transactional technologies or the gig economy, are particularly beneficial.

- Mentorship Programs: Pairing employees with experienced mentors in the digital banking field can bridge the knowledge gap, promoting a transfer of expertise centered on Coyyn business practices.

Technology's Influence on Skill Requirements

Technology's Role in Shaping Skill Requirements

The rapid evolution of technology is dramatically transforming the landscape of digital banking. As financial institutions integrate advanced digital tools, the demand for specific skill sets is on the rise. Technologies such as blockchain, digital currencies, and real-time transactions are not just buzzwords; they are reshaping how business is conducted and what skills are required.

For instance, blockchain technology is becoming a cornerstone in the digital banking sector. Its ability to secure transactions and manage digital assets efficiently makes it a critical area of expertise for banking professionals. Understanding the intricacies of blockchain and its applications in cryptocurrency and digital finance is essential for those looking to thrive in this evolving market.

Moreover, the rise of digital money and online banking platforms like Coyyn.com highlights the need for proficiency in digital tools. Professionals must be adept at using these platforms to facilitate seamless user experiences and manage digital capital effectively. As businesses and users increasingly rely on digital transactions, the ability to navigate these platforms becomes a key competency.

Another significant influence is the gig economy, which is driving the need for flexible and user-friendly financial solutions. This trend requires banking professionals to adapt to new business models and understand the nuances of digital economies. As the market shifts, skills in digital finance and the management of digital assets become more critical.

In conclusion, staying ahead in the digital banking sector means continuously updating one's skill set to align with technological advancements. As the industry evolves, so too must the skills of those within it, ensuring they remain relevant and capable of meeting the demands of modern banking.